Virginia is a former credit cards writer for NerdWallet. She is a journalist who has covered personal finance, business, real estate, architecture and design. Her work has appeared in the Philadelphia Inquirer, The New York Times, The Awl and Mental Floss.

Lead Assigning Editor Paul Soucy

Lead Assigning Editor | Credit cards, credit scoring, personal finance

Paul Soucy has led the Credit Cards content team at NerdWallet since 2015 and the Travel Rewards team since 2023. He was an editor with USA Today, The Des Moines Register and the Meredith/Better Homes and Gardens family of magazines for more than 20 years. He also built a successful freelance writing and editing practice with a focus on business and personal finance. He was editor of the USA Today Weekly International Edition for six years and received the highest award from ACES: The Society for Editing. He has a bachelor's degree in journalism and a Master of Business Administration. He lives in Des Moines, Iowa, with his wife, Sarah; his two sons; and a dog named Sam.

Fact Checked Co-written by Ellen Cannon Ellen CannonEllen is a former credit card writer for NerdWallet. She covered personal finance issues for more than 20 years at Bloomberg and Bankrate.com.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

We're long past the days when the only ways to apply for a credit card were going to a bank branch or mailing in a paper application. Now, many people looking for credit cards apply online, where you can fill out the application, have your credit checked and get approved in just a few minutes. Easy.

One could argue, though, that it's become almost too easy. When you can apply online for a card with so little effort, you can also easily end up with a card that's all wrong for you. Let's walk through the process of finding and applying for the right credit card for you .

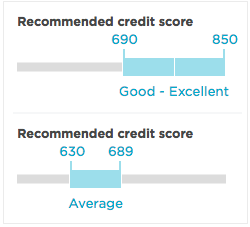

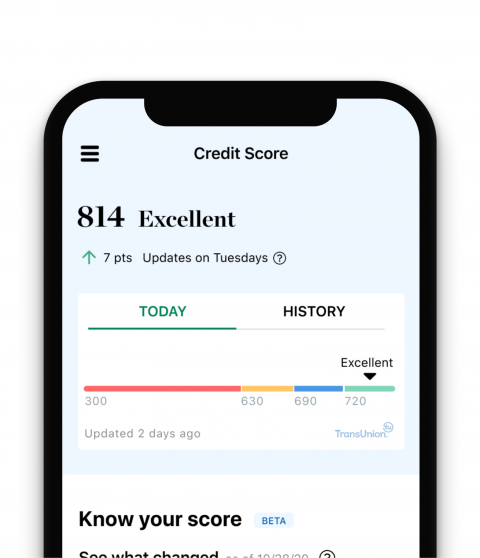

Credit card issuers approve applications based on credit scores , among other factors. Don’t know your score? We can get it for you: Just create an account , answer a few questions, and see your credit score. Once you know your score, you can see which cards you may qualify for. Scores are on a scale from 300 to 850. The ranges are:

If you have good credit, skip ahead to the next section. Otherwise, read on.

Even if you have poor credit, you still have options. You can apply for a secured credit card, where you deposit a certain amount of money with a credit card issuer to establish your line of credit. The deposit reduces the risk to the issuer, so these cards are available to many people with bad credit or no credit history. Secured cards are reported to the credit bureaus, so using one responsibly will build your credit history.

Ready for a new credit card?Nerdwallet+ members can earn $100 in rewards for paying their first bill on time with an eligible credit card.

GET STARTED

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Learn MoreThe Discover it® Secured Credit Card is the rare secured credit card that offers rewards — 2% cash back at restaurants and gas stations on up to $1,000 in combined purchases each quarter, and 1% cash back on all other purchases. It has an annual fee of $0 , and after seven months, Discover will review your account to see whether you're eligible for an upgrade to an unsecured card.

The Capital One Platinum Secured Credit Card is another great option. It, too, has an annual fee of $0 . You can get a $200 credit limit with a deposit as low as $49, for those who qualify. You could get access to a higher credit line with no additional deposit needed if you pay on time for as little as six months.

Find the best card for your credit Check your score anytime, and NerdWallet will show you which credit cards make the most sense.

In general, you can choose a credit card with a low ongoing interest rate, or you can choose one that gives you rewards. You're probably not going to get both in the same card. However, some rewards cards will give you an introductory period at 0% interest , after which the usual rate kicks in.

“ If you expect that you'll regularly carry a balance from one month to the next, choose a low-interest card. If you'll be paying your balance in full each month, choose a rewards card. ”

The decision is fairly easy: If you expect that you'll regularly carry a balance from one month to the next, choose a low-interest card. If you’ll be paying your balance in full each month, choose a rewards card. If you’re currently carrying a high-interest balance, think about transferring it to one with a 0% period to pay it off without interest.

If you think a rewards card is right for you, skip to the next section. Otherwise, read on.

Nearly all cards charge a balance transfer fee of 3% to 5% of the amount being charged.

The best balance transfer cards have a long 0% period, and in many cases the 0% APR applies not only to balance transfers but also to new purchases. Check the ongoing APR to see what interest rate you’ll be paying on any remaining balance or new purchases after the 0% period is up. The most cost-effective strategy is to pay off transferred balances before the no-interest period ends, and then pay your balance in full each month.

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Learn MoreThe U.S. Bank Visa® Platinum Card has a solid no-interest period: 0% intro APR for 18 billing cycles on purchases and balance transfers, and then the ongoing APR of 18.74%-29.74% Variable APR . The annual fee is $0 .

The Discover it® Cash Back gives you a decent 0% period on purchases and balances — 0% intro APR for 15 months on purchases and balance transfers, and then the ongoing APR of 18.24%-28.24% Variable APR — plus rewards that may compel you to keep using the card after the 0% period ends.

This decision may also be an easy one. If you travel a lot, want rewards you can redeem for travel or would like airline or hotel perks, you're a good fit for a travel rewards card. Cash-back cards, on the other hand, give you the most flexible reward of all: cash, which you can use to reduce your balance or even receive as a check or deposit in your bank account (depending on the card). Travel rewards cards tend to charge an annual fee, whereas most cash-back cards do not.

“ If you travel a lot, want rewards you can redeem for travel or would like airline or hotel perks, you're a good fit for a travel rewards card. Cash-back cards, on the other hand, give you the most flexible reward of all: cash. ”

If you want a travel rewards card, skip to the next section. Otherwise, read on.

Cash-back credit cards are the most popular type of rewards card, and they come in three basic varieties . Which one is right for you depends on how you spend money and how much appetite you have for actively managing your credit card rewards:

Flat-rate cards pay the same cash-back rate — say 1%, 1.5% or 2% — on all purchases. They require no additional effort, since the same rate always applies.

Tiered cards pay higher rates in specific categories, such as gas or groceries, and 1% everywhere else. With these cards, you need to remember which one to pull out depending on where you're shopping.

Rotating category cards pay 5% cash back in categories that change every three months and 1% on everything else. They require the most work: To get the high 5% rewards rate, you have to opt in to the bonus categories every quarter.

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Learn MoreIf you're keeping things simple, go with a flat-rate card. The Citi Double Cash® Card , for example, pays 1% cash back on every dollar you spend and then another 1% back on every dollar you pay back.

Several other flat-rate cards pay 1.5% upfront on every purchase, including the Capital One Quicksilver Cash Rewards Credit Card .

When looking at tiered cards, choose those with bonus categories that align with your spending. If you spend a lot on groceries, for example, check out the Blue Cash Everyday® Card from American Express . It pays 3% cash back at U.S. supermarkets, gas stations and online retail purchases. You'll earn this elevated reward on up to $6,000 a year in spending in each category. After that you'll earn 1%. You'll also earn 1% back on everything else. (Terms apply — see rates and fees .)

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Learn MoreIf you're a hardcore grocery shopper, check out the Blue Cash Preferred® Card from American Express , which gives you 6% back at U.S. supermarkets (on up to $6,000 a year in spending). It has a $0 intro annual fee for the first year, then $95. (Terms apply — see rates and fees .)

In bonus category cards, the aforementioned Discover it® Cash Back gives you 5% cash back in rotating categories that you activate, on up to $1,500 per quarter in spending, and 1% on all other purchases. The Chase Freedom Flex® offers similar terms. With these cards, recent bonus categories have included such things as grocery stores, gas stations, home improvement stores and restaurants.

There are two basic kinds of travel credit cards:

General travel cards give you points that you can redeem for travel expenses. These cards are more flexible, since you can use your points to book with any airline or hotel, or redeem them for credit on your statement against any travel purchase.

Co-branded cards give you points in a specific airline's or hotel chain's loyalty program. They're not as flexible as general travel cards, but they usually offer perks that general cards can't match.

“ General travel cards are far more flexible, but co-branded travel cards offer perks that general cards do not. ”

Most travel cards — both general and co-branded — charge an annual fee. And most good travel cards offer sign-up bonuses worth hundreds of dollars.

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Learn MoreA longtime Nerd favorite, the Chase Sapphire Preferred® Card , gives you bonus rewards in a variety of popular spending categories, including dining and travel. When you use points to book travel through Chase, points are worth 1.25 cents apiece. You can also transfer points to several major airline and hotel loyalty programs.

Another good option, the American Express® Gold Card . Among its perks: 3 points per dollar on flights booked directly with airlines; 4 points at restaurants (on up to $50,000 per year in purchases, then 1 point per dollar), 4 points at U.S. supermarkets (on up to $25,000 per year in purchases, then 1 point per dollar). Terms apply — see rates and fees .

The Capital One Venture Rewards Credit Card gives you an unlimited 2 miles per dollar spent on every purchase. Miles can be used to book travel or redeemed for statement credit against travel purchases; in both cases, miles are worth 1 cent apiece.

Airline credit cards

Depending on where you live, you might have a great deal of choice in which airline you fly, or you may have very little. Either way, if you travel frequently and can (or must) do so on a single airline, it can be worth it to carry that airline's credit card. You'll earn frequent-flyer points with every purchase (and usually extra points with airline purchases), and you may get free checked bags, upgrades or other perks. Cards for major carriers include (click on a link to learn more or apply):

Hotel credit cards

With co-branded hotel cards, each purchase earns you points in a hotel chain's loyalty program, and purchases at that hotel chain earn extra points. Points can be redeemed for free nights, and the card often entitles you to room upgrades and other perks. Co-branded cards for major chains include (click on a link to learn more or apply):

To view rates and fees of the Blue Cash Preferred® Card from American Express , see this page . To view rates and fees of the Blue Cash Everyday® Card from American Express , see this page . To view rates and fees of the American Express® Gold Card , see this page . To view rates and fees of the Delta SkyMiles® Gold American Express Card , see this page . To view rates and fees of the Hilton Honors American Express Surpass® Card , see this page .

About the authorsYou’re following Virginia C. McGuire

Visit your My NerdWallet Settings page to see all the writers you're following.

You’re following Ellen Cannon

Visit your My NerdWallet Settings page to see all the writers you're following.

Ellen Cannon is a former NerdWallet writer covering credit cards. She has been a writer and editor at Bloomberg and Time Inc. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105