A flexible security interest or lien for lenders covering a group of business assets that changes from time to time.

Written by Gabriel Lip Reviewed by Kyle PeterdyOver 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

A floating charge (or floating lien) gives a lender a broad legal interest over a pool of assets owned by a business and which serve as collateral to secure debt. It matches operating debt to assets that change, often current assets.

Unlike a fixed charge, a floating charge does not attach (or place) a specific charge or lien on uniquely identifiable assets, such as serialized equipment or a building. Instead, it grants lenders an interest over generic categories of business assets described within a contract, such as a general security agreement.

The value and quantity of the collateral assets covered by a floating charge are dynamic. They can be traded, sold, or disposed of over the business operations’ lifespan. The borrower does not need the lender or charge-holder to consent to these transactions.

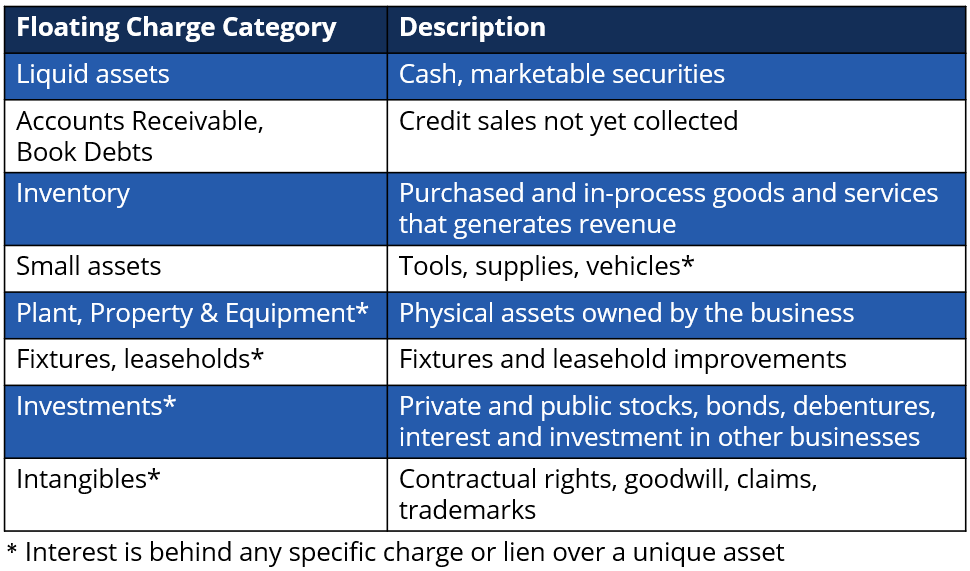

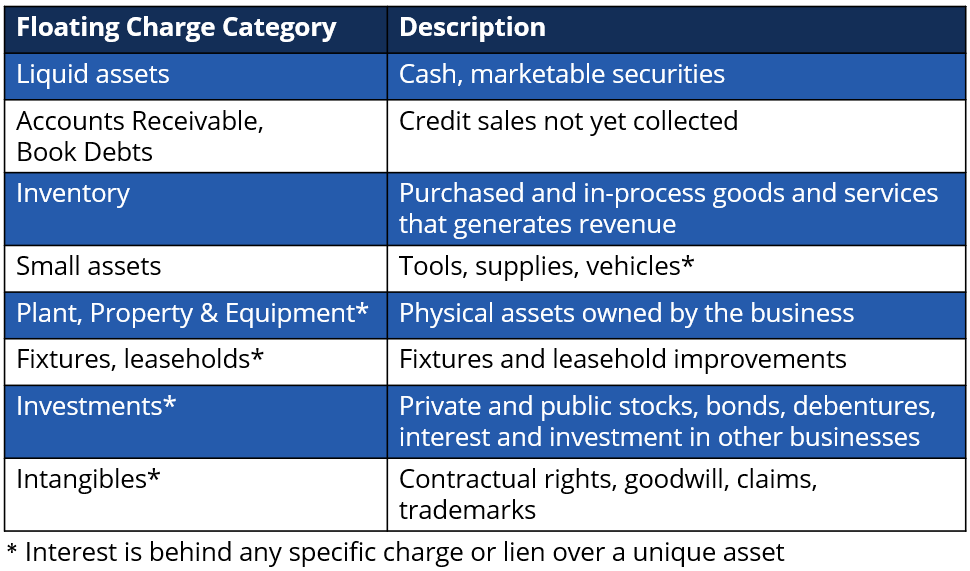

Lenders use a floating charge to secure financing against groups of similar assets rather than taking an interest in an individual asset. Asset categories, including accounts receivable and inventory, are typically held short-term ; these are also considered generic business assets (meaning they are not unique).

A floating charge is a flexible instrument that lenders value and use to support revolving credit facilities to finance operations along with equity. It is common in lending arrangements as it leverages general assets to provide the liquidity critical for operations.

Lenders that rely on a floating charge are normally the primary lender and understand that the underlying collateral is dynamic. In some instances, a portion of the general assets may be used to support other debt and creditors, as in the case of accounts receivable factoring . Floating charge lenders may agree to subordinate some of their rights to another creditor to provide secondary financing to the business.

A floating charge is over a pool of assets and can cover both present and future ownership of assets in the ever-changing pool. This is useful when assets such as accounts receivable and inventory constantly change. The assets within a group are not particularly distinguishable (cash is the ultimate example of a completely fungible asset).

A fixed charge can only be placed over unique assets, such as serialized goods, or fixed assets , like plant, property, and equipment. This charge provides certainty to a lender by identifying their unique collateral to others. When a fixed-charge lender provides financing against unique collateral, their debt and their collateral become inseparable until it’s repaid (an example is a collateral mortgage held against a mortgage loan).

A floating charge gives lenders generic rights over general security. They may gain further rights upon a business default or insolvency. Sometimes, a lender may add a fixed charge over unique assets within a generic pool. For example, they may wish to have the right to restrict the disposal of a particular asset or prevent its availability as collateral for another lender.

A fixed charge gives lenders legal rights; for example, they may restrict a change in ownership without explicit consent. In effect, this ensures the repayment of their debt if something happens to the asset. Although a unique asset may be part of an asset category described by a floating charge, a fixed charge offers more legal rights upfront.

As lenders assess the impact of total financing on cash flow, they want a complete picture. For example, when an identifiable asset is sold to or financed by another lender without their knowledge, it can change the credit risk picture.

A fixed charge can enhance the lender’s rights even when a floating charge already supports debt financing. Legal notification is required to a fixed charge holder on any transaction. Notification allows lenders to consider their consent (along with any conditions); alternatively, they may decline and maintain their fixed charge on the collateral.

A floating charge offers great financing flexibility by referring only to a pool of assets. Financing levels can “float” whenever the pool changes and adjust along with the lending value. Lenders’ involvement is limited – they are not notified or have to provide consent to the owner whenever the assets in the pool change via purchases and disposals.

A fixed charge is less flexible. Typically, collateral with a fixed charge cannot change, even if its value may rise and fall. An exception is for attachments affixed to the property or equipment that become permanently part of an asset with a fixed charge. For example, a mortgage is a fixed charge to finance real property, and improving the property can change the collateral (and its value) for the fixed charge holder. Depending on the agreement, the mortgage holder can restrict a material change to the property, its sale, and change in ownership. A fixed charge limits the owner’s flexibility.

When a pool of assets in question changes quickly, placing such restrictions (or requiring consent from the lender) is not feasible during normal operations.

In short, the value of a floating charge is to provide financing flexibility to conduct business using current assets, without the friction associated with a fixed charge. Lenders monitor the financial performance of businesses under a floating charge to ensure it meets the terms of flexible financing. Financing using fixed charges typically does not require such flexibility.

With a fixed charge, tangible assets, such as property or equipment, are used to secure a specific debt. In cases such as a default under the lending agreement, or insolvency, lenders have legal rights and remedies to take over ownership of the asset to repay the loan.

For example, suppose a borrower fails to meet the repayment commitments for a mortgage. In that case, the bank may take ownership of the property via foreclosure and recover its exposure by selling the property.

Regarding a floating charge over general assets like accounts receivable and inventory, additional steps are required to get repayment rights. If a company defaults on the debt or becomes insolvent, converting from a floating charge into a fixed charge is how a lender can gain rights to compel a sale.

Conversion to a fixed charge is not preferred, as lenders do not typically want the cost or effort to take over, maintain and dispose of such assets before getting repaid.

The conversion process is sometimes referred to as crystallization . Depending on the circumstances and legal jurisdiction, the legal process may be automatic, or the lender may be required to give formal notice in order to initiate the conversion. Legal counsel is always advised on the specific steps.

Once a floating charge converts to a fixed charge, the business is restricted from using or selling the underlying assets without obtaining consent. A converted floating charge has a lower legal priority to the sale proceeds whenever a court decides a fixed charge exists over the same asset from another lender before this conversion.

When both types of charges exist upfront over an asset, a floating charge is worth less to a lender than one with a fixed charge, given the possibility of a court determining that a fixed charge holder comes first. Lenders must weigh this value against the reduced flexibility for the asset owner to conduct business if a fixed charge exists over the asset.

CFI is a leading provider of financial analysis programs, including the Commercial Banking & Credit Analyst (CBCA)™ certification for finance professionals looking to take their careers to the next level.

To keep learning and developing your knowledge base, please explore the additional relevant CFI resources below:

Stand out and gain a competitive edge as a commercial banker, loan officer or credit analyst with advanced knowledge, real-world analysis skills, and career confidence.