Image with Capitalization Table written" width="1024" height="683" />

Image with Capitalization Table written" width="1024" height="683" />Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

A cap table (also called capitalization table) is a spreadsheet for a startup company or early-stage venture that lists all the company’s securities, such as common shares, preferred shares, warrants, who owns them, and the prices paid by the investors for these securities. It indicates each investor’s percentage of ownership in the company, the value of their securities, and dilution over time.

Cap tables are created first, before other company documents, in the early stages of a startup or venture. After a few rounds of financing, the cap tables become complex and list the potential sources of funding, initial public offerings, mergers and acquisitions, and other transactions.

Image with Capitalization Table written" width="1024" height="683" />

Image with Capitalization Table written" width="1024" height="683" />

Apart from recording transactions, a cap table also comprises many legal documents such as stock issuances, transfers, cancellations, conversion of debt to equity, and other documents. The executives must manage all these transactions and documents accurately to show the events since the company’s inception.

The simplest form of cap tables lists the shareholders at the beginning and their respective share ownership. Cab tables are used by venture capitalists, entrepreneurs, and investment analysts to analyze important events such as ownership dilution, employee stock options, and the issue of new securities.

Most companies use spreadsheets to create a cap table at the inception of the business. The cap table should be designed in a simple and organized layout that clearly shows who owns certain shares and the number of outstanding shares. The most common structure is to list the names of investors/security owners on the Y-axis, while the type of securities is listed on the X-axis.

Alternatively, a company can use a spreadsheet template that allows for the addition of information and figures related to their business. The first row should indicate the total number of shares of the company. The subsequent rows should list the following:

A separate table in the capitalization table should include the following:

The company’s founders are listed first in the table, followed by executives and other employees who own equity, and then investors such as angel investors and venture capitalists.

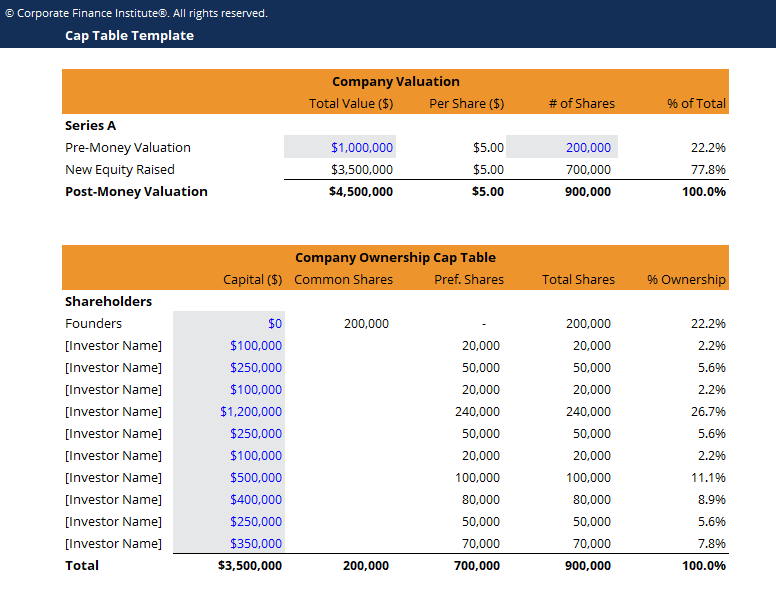

Below is a cap table example from one of CFI’s many free excel templates.

The spreadsheet below contains two sections – valuation and ownership. All numbers in blue are hard-coded assumptions and all numbers in black are formulas.

In the valuation section, enter the current company value (i.e. $1 million) and the current number of shares outstanding (i.e. 200,000).

In the ownership section, enter the dollar value each investor is contributing to the funding round (i.e. $100,000 for investor 1, $250,000 for investor 2, etc.).

Enter your name and email in the form below and download the free template now!