Federal withholding tables lay out the amount an employer needs to withhold from employee paychecks. This includes federal income taxes, as well as other taxes, such as Social Security and Medicare taxes.

When running a business, there are many important factors to consider, including payroll. Although setting up payroll can be a bit daunting at first, with a little guidance and preparation, you can easily navigate the process.

You'll need to gather some important paperwork and choose a reliable payroll system . One of the most important factors for running payroll is the IRS withholding tax tables for 2024, which ensures you're properly withholding taxes for your employees. Don't worry, though—with the right resources and support, you can set up payroll smoothly and efficiently.

Federal tax withholding tables are different from how they used to be. The IRS adjusts the income threshold every year for inflation. That means federal income 2024 withholding tables change every year, in addition to the tax brackets.

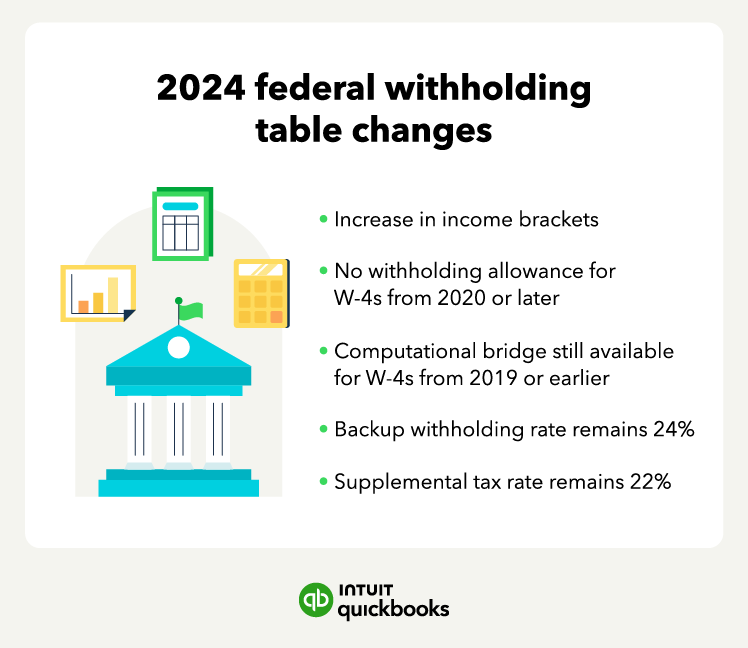

The federal withholding income tax table for 2023 had lower income brackets versus 2024. Here’s what you need to know for the 2024 withholding tables:

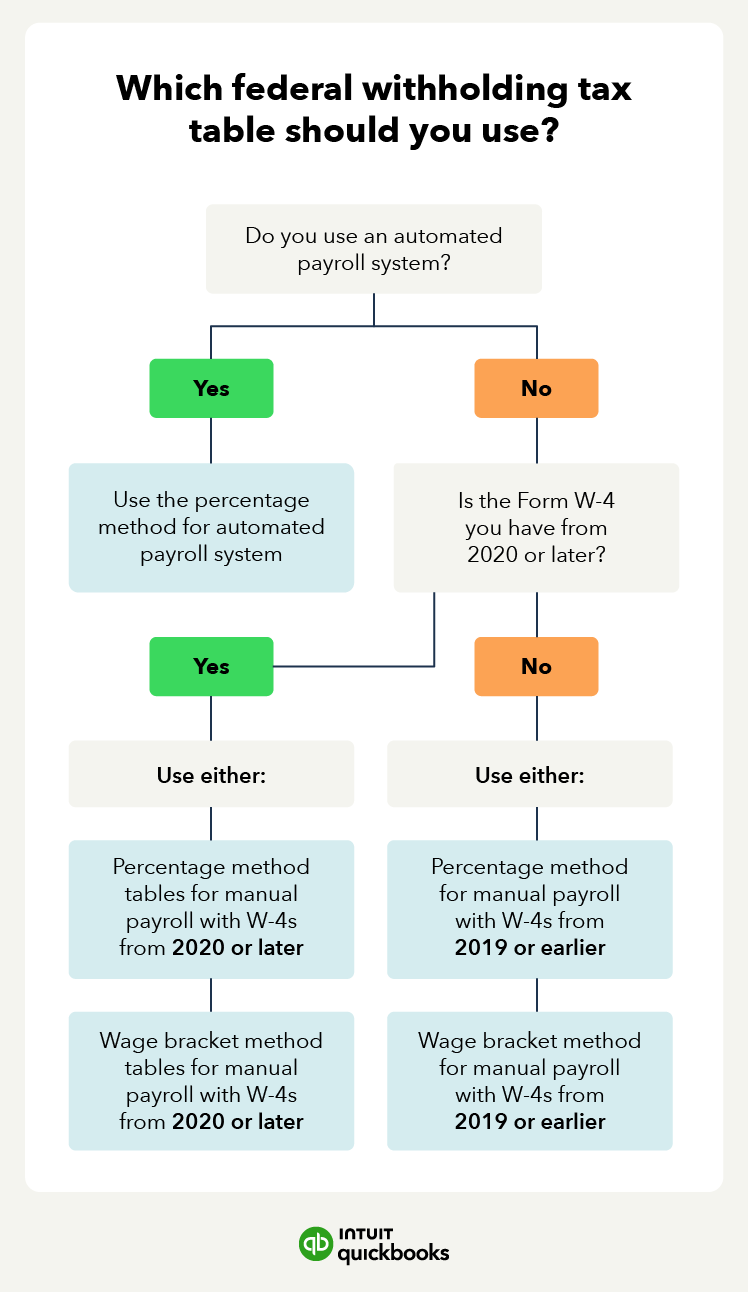

Here are the IRS withholding tax tables for 2024 for employers that use an automated payroll system.

The first federal tax table from the IRS is if you have a W-4 from before 2019 or if the W-4 is from 2020 or later and the Step 2 box is not checked :

The next federal 2024 withholding table from the IRS is for automated payroll systems if the W-4 is from 2020 or later and the box in Step 2 of the W-4 is checked:

If you run payroll using a manual system, you’ll use different tables than those for businesses that use an automated payroll system built into their accounting software .

If you use a manual payroll system and have a W-4 form for 2020 or later, you can use either of these:

If you use a manual payroll system and have a W-4 from before 2019, you can use either of these:

Note that withholding allowances are not part of W-4s of 2020 or later. Before the change, employees were able to claim more allowances to decrease their federal tax withholding. But with the newer W-4s, employees can only lower their withholding by using the deduction worksheet or claiming dependents.

A federal withholding tax table is usually in the form of a table or chart to simplify this process for employers. To determine the withholding amount, you will need an employee’s W-4 form , filing status, and pay frequency. Every new employee at a business needs to fill out a W-4 for this purpose.

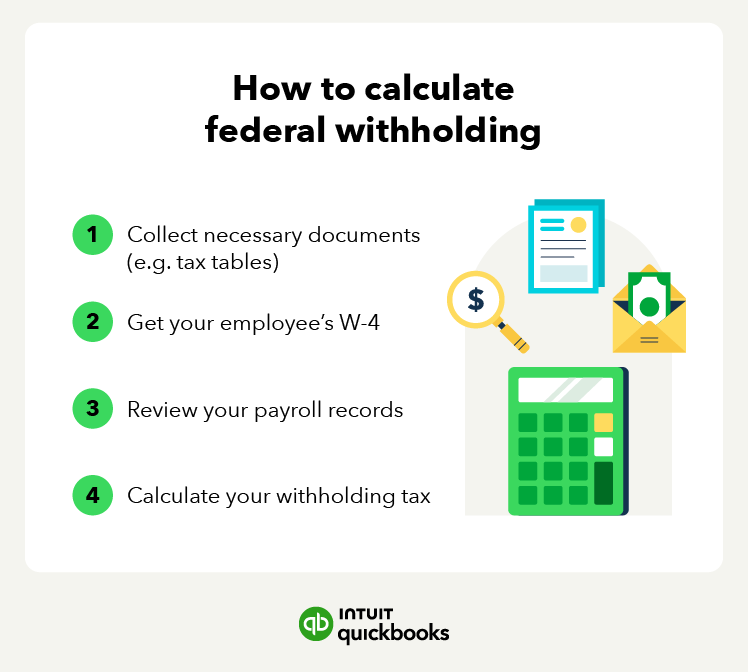

Let’s discuss how to calculate the withholding tax. Follow the steps below to calculate the necessary federal withholding income tax rate:

Gathering all relevant documents from your employees is the first step in correctly calculating withholding tax. To calculate withholding tax, you’ll need your employee’s W-4 form, gross pay for the pay period, and an income withholding tax table.

It’s important your employee fills out their W-4 correctly for your withholding tax calculations. Your employee will have to fill out their filing status, number of dependents, and additional income information. You will need to reference this form to calculate withholding tax.

To calculate employee withholding tax, you will need to review important information from your payroll.

As an employer, you will need to look at these payroll records:

An employer is also responsible for payroll withholding , which is money taken out of an employee’s gross wages. This money taken is then used to pay the employee’s portion of the payroll taxes to the federal government.

There are also payroll deductions—money taken out of an employee’s paycheck to pay for costs like employee benefits. Payroll deductions can either be mandatory, which employers are required to pay, or voluntary, which employees can pay.

Understanding payroll can be overwhelming, which is why it is useful to use a payroll accounting service to keep track of payroll costs and employee compensation.

Get help and guidance when you need it from real QuickBooks experts.

Start hereThe final step is to calculate the withholding tax. However, you’ll need to use one of several tax tables. There are two federal income tax table methods for use in 2024—the wage bracket method and the percentage method.

There are three key types of withholding tax methods: wage bracket, percentage, and computational bridge:

The method you choose will depend on your payroll system and which W-4 you have from your employees.

The wage bracket method is a simpler method, and it tells you the exact amount of money to withhold based on an employee’s taxable wages, number of allowances, marital status, and payroll period. It does not involve any calculations to determine federal withholding tax.

QuickBooks Tip:

If you use a manual payroll system, you can use either the wage bracket or percentage method.

The percentage method is a bit more complex as it involves more calculations. It differs in that it has no wage limits. You can use this method if your employee’s wage exceeds the wage bracket limit. If you use an automated payroll system, it will use the percentage method.

Employers can use a computational bridge to treat 2019 or earlier W-4s as if they were 2020 or later W-4s, specifically for tax withholding purposes. The computational bridge helps reduce complexity by allowing you to use data from older W-4s to calculate the withholding for your employees.

The bridge is optional, but it does mean you don’t have to use separate rules and withholding tables if you have older W-4s.

There are four steps to the bridge:

QuickBooks Tip:

If your employees filled out a 2020 or later W-4, note that they can no longer request adjustments to their withholding allowances.

Correctly calculating withholding taxes is crucial for many reasons. To run a business efficiently and pay your employees accurately, you want to ensure employee W-4 forms are complete.

Using a payroll service like QuickBooks Payroll to handle calculations can simplify your life as a business owner. QuickBooks Payroll offers everything from HR support to a paycheck calculator , so you can spend less time focusing on payroll and more time running your business.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit, and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

The federal withholding tax rates from the IRS for 2024 are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. This is unchanged from 2023.

Do employers have to withhold taxes?

Yes, employers do have to withhold taxes. Incorrect federal withholding tax calculations can result in many issues for your business. An employer is legally responsible for withholding payroll taxes and paying those taxes to the Internal Revenue Service (IRS).

The federal withholding tax an employee will pay will depend on filing status and the amount of money they make. This will depend on the individual’s filing status, such as single or married filing jointly.

Yes, the federal withholding tax tables are different for 2024. The IRS adjusts income thresholds for the tables each year to account for inflation. Thus, the federal income withholding tables change every year.

Important pricing details and product informationMoney movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.